Features

Asset Management

Streamline tracking and management of your business assets seemlessly.

Business Analytics

Harness your data for informed decision-making and business growth.

Calendar Management

Organize and manage your team's schedule efficiently and view everyones calendar.

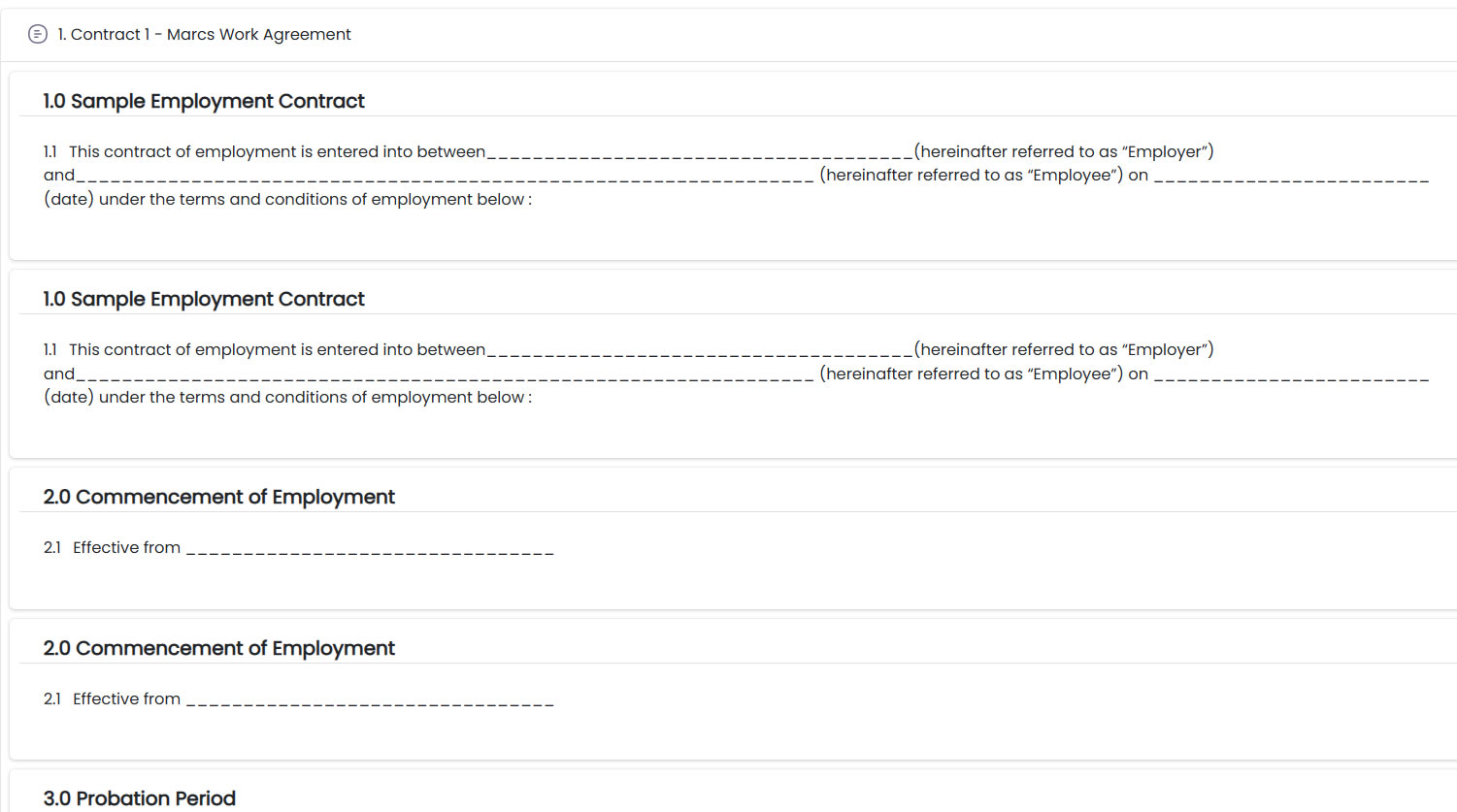

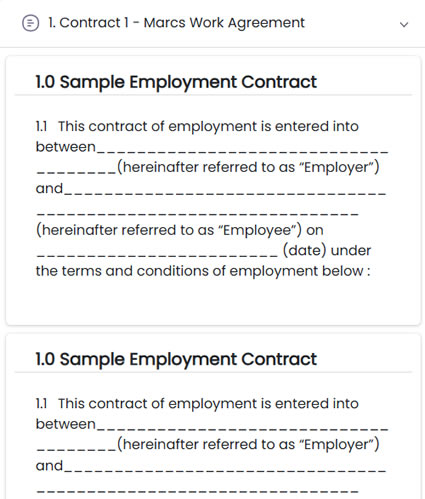

Document Creation

Centralize your documentation for easy access and management.

Estimation Software

Generate accurate and rapid estimates to win more jobs and improve conversions.

Gantt Charts

Visualize your project timelines for better progress tracking with live data.

Invoicing

Create professional invoices and manage payments seamlessly.

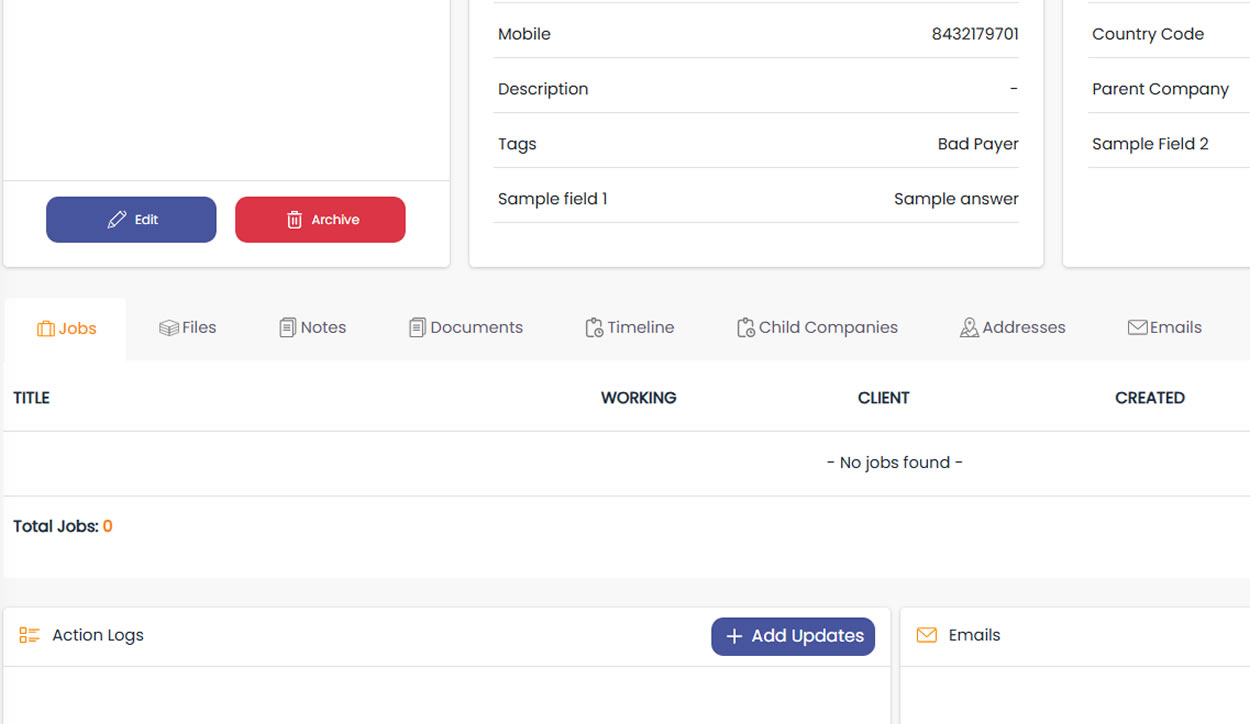

Project / Job Management

Coordinate and control your projects for optimal outcomes to meet budgets and timelines.

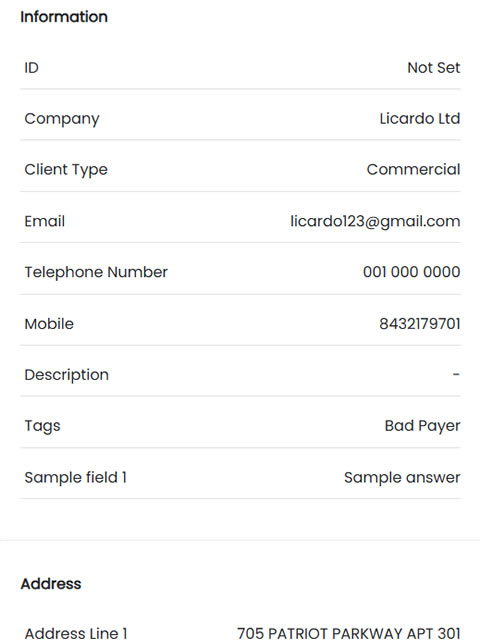

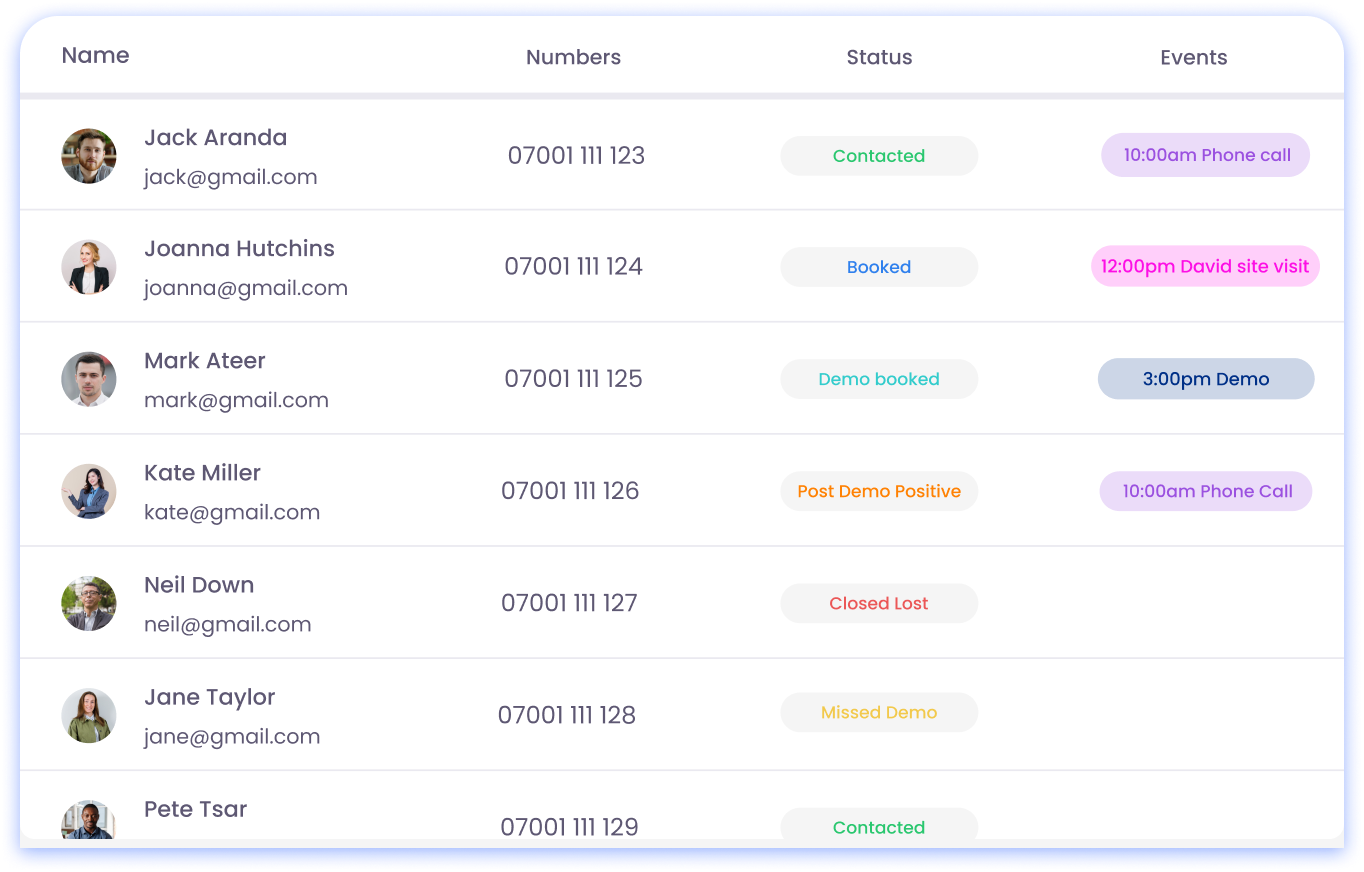

Lead Management

Unlock exponential growth with our streamlined and comprehensive lead management tool.

Live Product Pricing

Access real-time product pricing for accurate and easy cost estimation.

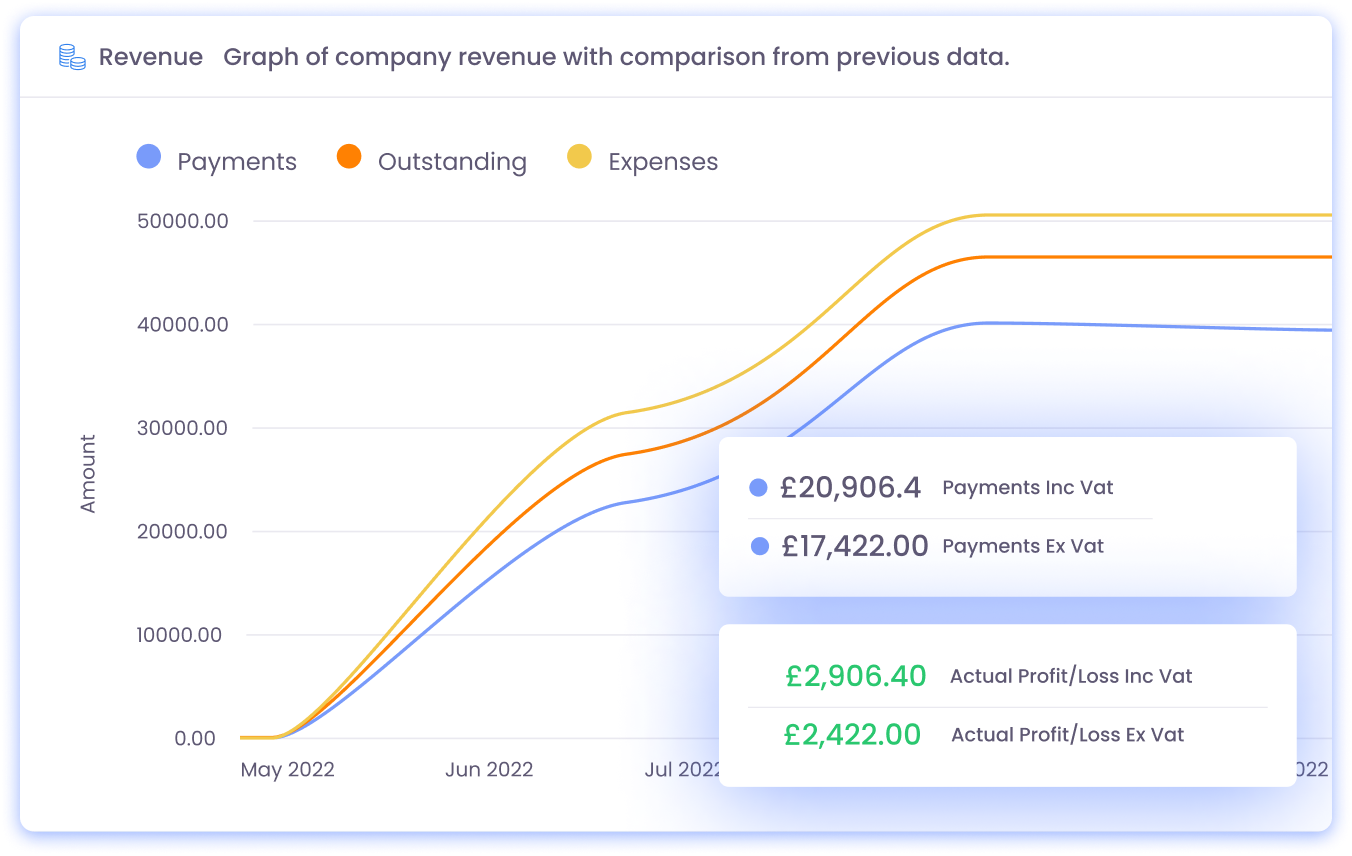

Profit and Loss

Track your financial performance with detailed profit and loss data.

Route Mapping

Optimize your team's routes for time, cost efficiency and wear and tear.

SMTP Email Set Up

Send and receive professional emails directly from the platform.

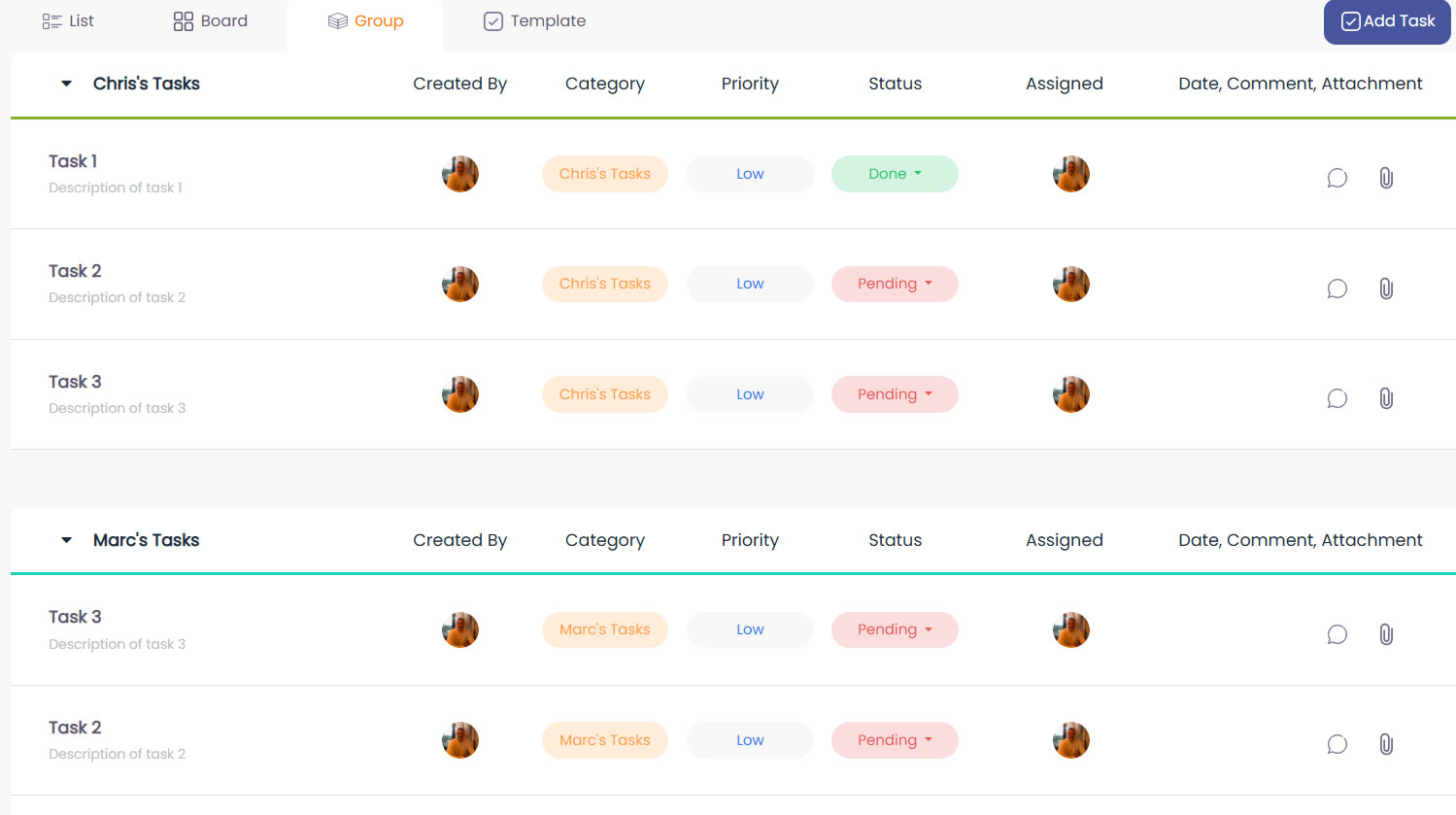

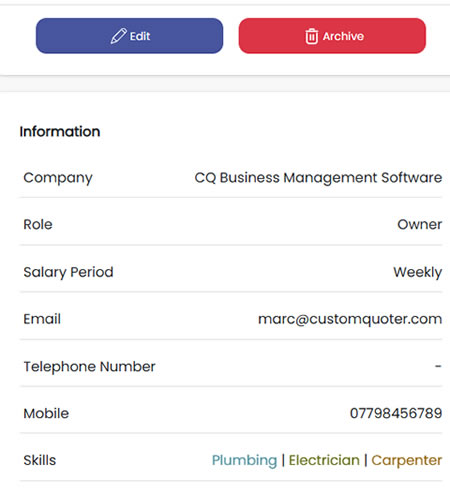

Team Management

Assign tasks, track them and manage your team's workload effectively.

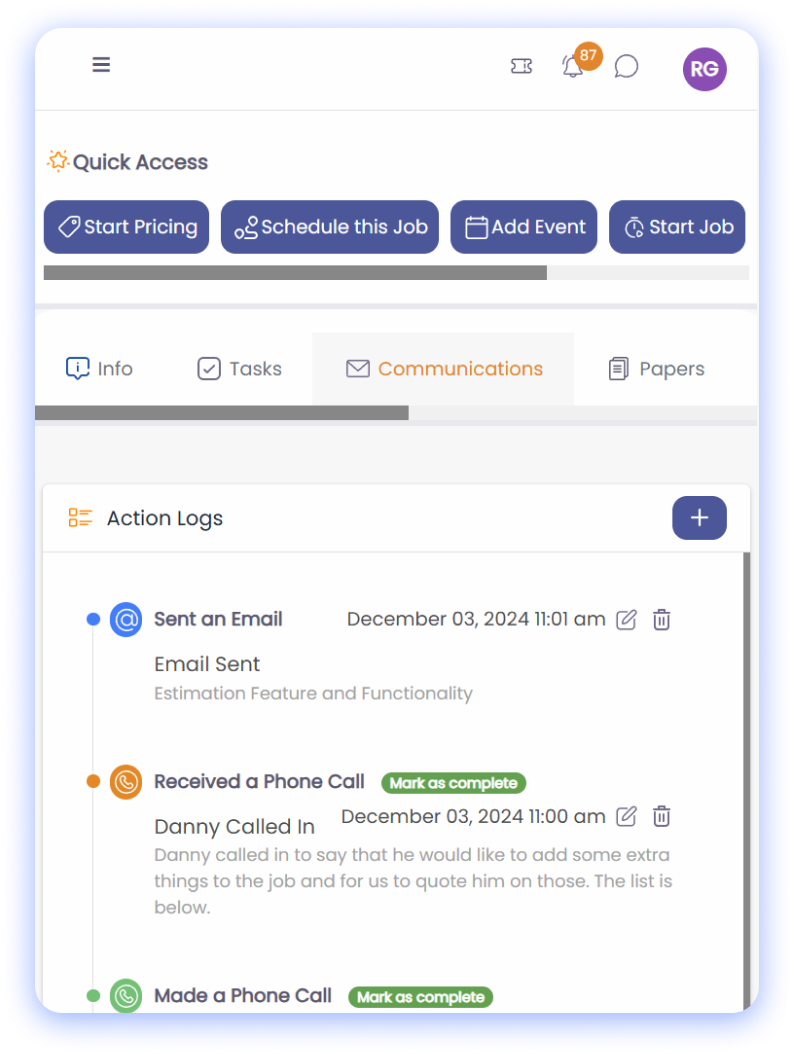

Team Communication

Foster real-time communication within your team for better collaboration.

Timesheets

Track your team's work hours and locations with geo-located timesheets.

Industries

Accounting

Streamline client work, compliance, and reporting — all in one platform

Events Management

Coordinate events, teams, and timelines effortlessly — all in one system.

Landscaping

Manage quotes, jobs, teams, and materials — all in one place to grow your landscaping business with ease.

Roofing

Streamline site scheduling, team coordination, and project documentation — built for the fast-paced world of roofing.

Arborist

Streamline quoting, job tracking, and team scheduling for every tree care project.

Gas Engineer

Track jobs, certificates, and team schedules with ease — all from one streamlined system.

Marketing

Streamline campaigns, client work, and team collaboration — all from one central system built for creative agencies.

Stadium Management

Coordinate teams, vendors, and maintenance schedules seamlessly — all in one unified operations platform.

Architects

Keep projects, drawings, tasks, and teams aligned from concept to completion.

Grounds Maintenance

Streamline scheduling, routing, and team coordination to keep every site perfectly maintained.

Plumbing

Manage call-outs, scheduled work, and compliance documentation with ease — all from one simple platform.

Surveyors

Manage site visits, reports, and client communication with precision and clarity — all in one place.

Electricians

Manage jobs, schedules, and compliance with one powerful system built for electrical teams.

HVAC

Streamline installations, servicing & maintenance tracking with one connected system to keep operations running smoothly.

Pool & Spa

Manage recurring services, one-off installs, and client communication — all in one clear, streamlined system.

Web Design & Development

Keep projects, clients, and creative workflows perfectly in sync — from brief to launch.

Teams

BenefitsAbout

BlogBusiness Audit